175 |

|

|

|

T-1000 |

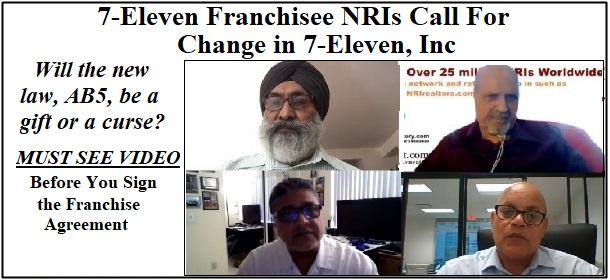

7-Eleven Franchisee NRIs Call For Change in 7-Eleven, Inc

Under California work reform law AB5,

Tension Escalates between 7-Eleven Franchisees & 7-ELEVEN Inc

- Is 7-ELEVEN Inc the Employer of Its Franchisees or Their Employees

- Is 7-ELEVEN Company trying to get an exemption for franchising in California from AB5 instead of changing the structure of their agreement to satisfy the ABC test

- 7-Eleven Franchisees Raise Concerns Over Company’s Retaliatory Tactics

Will the new law, AB5, be a gift or a curse?

-----------

WORTH TO SEE VIDEO- HELP YOU & Your NRI Community

Los Angeles, Oct 14, 2020

NRIpress.com/Ramesh/ Ramesh/ A.Gary Singh

The franchise owners claim the company is treating them like store managers, not business owners. The National Coalition of Associations of 7-Eleven franchisees (NCASEF) supports the AB 5 law in California.

Well-known brands like McDonald’s and Planet Fitness, 7-Eleven operators are not actually independent contractors because:

- 7-Eleven, Inc. (SEI) runs the stores.

- The franchisees own none of their own fixtures or equipment;

- They are not party to the lease for their location

- They must deposit all sales receipts into SEI’s business bank account.

Jaspreet Dhillon, a Los Angeles area 7-Eleven franchisee and Treasurer of the National Coalition of Associations of 7-Eleven Franchisees (NCASEF) said:

- They treat us like glorified store managers

- AB 5 represents a chance for 7-Eleven to change its system so that California’s hundreds of 7-Eleven franchisees could really be running their own businesses, but that is not what SEI wants.

- 7-Eleven claims that its franchisees should not be covered by AB 5 and is attempting to persuade state legislators to grant a carve-out for franchising in the AB 5 law.

- EI is trying to get an exemption for franchising in California from AB5 instead of changing the structure of their agreement to satisfy the ABC test and therefore AB5.

- B5 will force SEI to change the status quo by either accepting us as employees and its legal consequences or change the structure of its agreement to satisfy AB5.

- A similar effort by 7-Eleven to obtain a carve-out In Massachusetts failed.

California’s sales tax deferment program came as a huge relief for businesses but not for 7-Eleven store owners because SEI controls the finances of every store.

- Requires franchisees to deposit receipts from store operations daily/ even over weekends – into a bank account owned by SEI, and failure to do so is considered a “breach of contract

- Only a fraction of franchisees took advantage of the program while SEI is enjoying the cash flow intended for us.

- I had to fight SEI so that we could avail of Governor Newsom’s aid for deferring the sales tax collected for the first and second quarter of 2020 for up to $50,000.

California’s New Bill AB5 law that categorizes workers either as employees or independent contractors, is at the heart of a battle between 7-Eleven, Inc., the chain’s parent company, and its franchise owners, a large majority of whom are NRIs (Non-Resident Indian), mostly from Punjab.

The National Coalition of Associations of 7-Eleven franchisees (NCASEF) said:

- NCASEF supports the law and disputes the International Franchise Association’s claim that it will make “franchising’s future uncertain in California.

|

|