| Connecting

over 25 millions NRIs worldwide |

|

|||||||||||||||||||||||

|

||

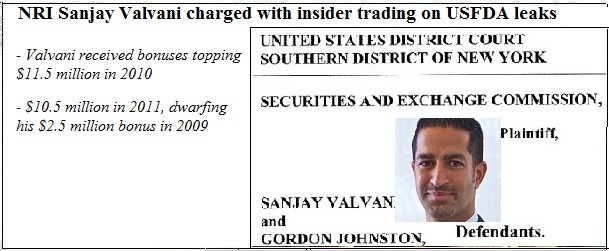

New York, June 16, 2016 NRIpress.club NRI Sanjay Valvani, 44, a Manhattan hedge fund manager was charged on Wednesday with trading on confidential tips about drug approvals, in one of the biggest insider trading cases. NRI Preet Bharara, the United States Attorney for the Southern District of New York along with the team- Diego Rodriguez, the Assistant Director-in-Charge of the New York Field Office of the Federal Bureau of Investigation (“FBI”), and Elton Malone, Special Agent in Charge, Special Investigations Branch, U.S. Department of Health and Human Services, Office of Inspector General (“HHS-OIG”), announced yesterday that NRI Sanjay Valvani, Hedge Fund Manager Allegedly Made $32 Million off Insider Information From the FDA Preet Bharara has won dozens of insider trading convictions over the last several years, including of hedge fund manager Raj Rajaratnam and Steven A. Cohen’s firm SAC Capital Advisors. NRI Sanjay Valvani, allegedly received tips about drug approvals ahead of their public announcement from the former FDA official, Gordon Johnston.

The prosecutors said: In July 2010, Momenta won approval and causing its stock to rise 82 percent in one day, Valvani made $25 million from selling his Momenta stock, and closing bets that Sanofi stock would fall because of the new competition. In one instance, in 2010, Valvani initiated a long position on Momenta Pharmaceuticals and a short position on Sanofi. Shortly there after, the FDA gave approval to Momenta to manufacture enoxaparin, a generic version of Sanofi’s brand name drug, Lovenox. Shares of Momenta rose, and Sanofi’s stock dropped …..NRIpress.club/ Surinder Mehta ————————- Indian-origin hedge fund manager charged with insider tradingNew York, June 16, 2016: A hedge fund manager of Indian origin has been charged with participating in a stock market insider trading scam involving generic drugs that allegedly netted him at least $25 million in profits, according to US authorities. New York federal prosecutor Preet Bharara, who announced the charges on Wednesday, said that Sanjay Valvani made a deal with a former US drug regulatory official to get “highly confidential” information about pending approval of generic drug applications and used them to make trades, “reaping millions of dollars in illegal profits”. This is the latest instance of Wall Street fraud prosecutions involving Indians, several of whom have faced charges or sentenced to prison terms in recent years. Valvani, who surrendered to authorities on Wednesday, was a partner at Investment Adviser-A and focused on health care portfolios. As part of their deal, Gordon Johnston, a former deputy director at the US Food and Drug Administration (USFDA) dealing with generic drugs, gave Valvani inside information about the approval of the generic version of the drug enoxaparin that is used to treat deep vein thrombosis, authorities alleged. Using that information, Valvani traded on the shares of two companies likely to profit from the USFDA approval and made $25 million in profits and also shared the information with Christopher Plaford, a former portfolio manager at Investment Adviser-A, authorities said. Both Johnston, who is now a political intelligence consultant, and Plaford have pleaded guilty to the charges against them and are cooperating with the government investigation, officials said. The alleged scam ran from 2005 to 2011, according to them. The Securities and Exchange Commission (SEC) has separately filed civil charges against Valvani, Johnston and Plaford. Enoxaparin was originally made by Sanofi-Aventis and marketed under the brand name Lovenox. By 2005, three groups of publicly traded pharmaceutical companies had sought USFDA and one of them was “by a publicly traded pharmaceutical company that had partnered with Momenta Pharmaceuticals, Inc.,” prosecutors said. Momenta said on its website that it had collaborated with Sandoz to produce a generic version of Lovenox, which received USFDA approval in 2010. Prosecutors said that Johnston was retained by Valvani to provide “political intelligence” about the timing of USFDA’s approval of generic drugs and was paid hundreds of thousands of dollars for his consulting work. Johnston used his contacts as a former USFDA official to get the information, officials said. Valvani is the latest person of Indian origin to face insider trading charges. Rajat Gupta, former CEO of the consultancy company, McKinsey, is the best known of them and was convicted in 2012 on insider trading with Raj Rajaratnam, a hedge fund operator of Sri Lankan origin. Anil Kumar, a former McKinsey employee, pleaded guilty in the same case.

|

||

| |

|