NRIpress.com, Inc.'s Shares Updated, January 01, 2018

|

| |

I |

WHO CAN BECOME SHAREHOLDER OF NRIpress.com, Inc under Incentive Stock Options (ISO) & Non-qualified stock options (NQOs) |

|

|

The Gold, Diamond and Platinum members members who sponsored our NRI News or adverisement payments of their businesses, and also like to help the company as advisors or news operation....... can be considered as investment in our special incentive share program. For Example:

- Assume that you paid NRIpress.com Inc., $10,000 (ten thousand $) to sponsor news or advertisement your business within last 10 years or made committment or you offer to provide services towards media next 5 years as an officer........ then you will be eligible to buy (10 times you paid $ amount) upto 100,000 shares with 75% discount under our reserved incentive prog. shares.

NOTE: This offer will be valid only first-come, first-serve basis only |

| |

II |

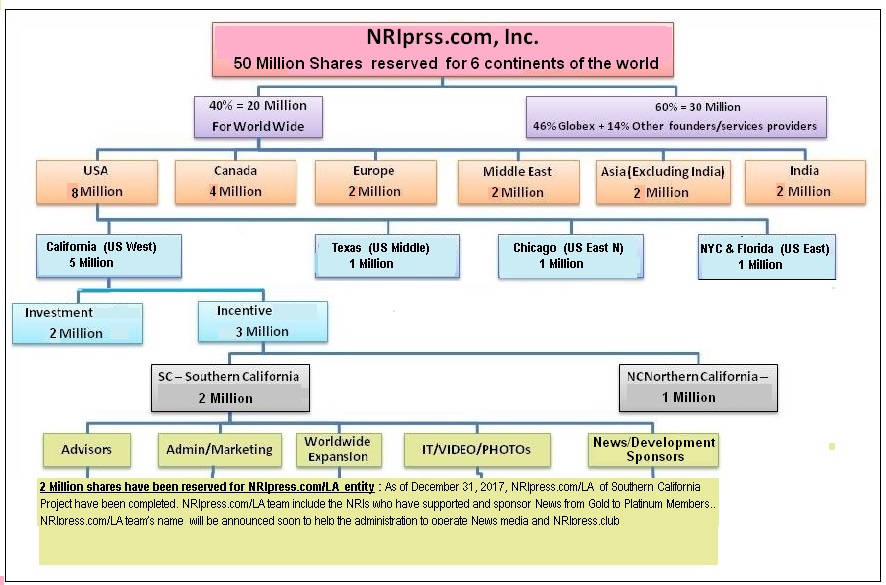

OFFICAL CHART--NRIpress.com, Inc. |

| |

|

| |

|

| |

III |

NRIpress.com, Inc's SHAREHOLDER CATEGORIES or Entitities |

| |

|

| |

SHAREs ISSUE TO |

|

% |

ACTUAL SHARES |

To WHOME and PURPOSE |

| 1 |

FOUNDERS |

US |

45% |

22.5M |

US-Founders--Globex Management- |

| 2 |

CO-FOUNDERS |

Canada and India |

15% |

7.5M |

Canada and India- Co-Founders |

| 3 |

US-IT/Advisors /News supponsors-Model |

10% |

5M |

LA -US/Canada Model |

| 4 |

IT |

Web Developer |

5% |

2.5M |

IT Individual or IT Company who will take full responsibility to develop. Incentive Shares 5 times plus 75% discount (Company can compensate) |

| 5 |

Operation |

5% |

2.5M |

Run the operation of the projectpIncentive Shares 5 times plus 75% discount (Company can compensate) |

| 6 |

INVESTORS |

|

10% |

5M |

For expansion and update |

| 7 |

RESERVE |

|

10% |

5M |

For Entreprneurs/joint ventures |

|

|

IV |

MEANING of Incentive Stock Options (ISO) & Non-qualified stock options (NQOs) |

| |

The companies or individuals, who like to take NRIpress.com to the next level, two stock options are available:

Incentive Stock Options (ISO):

- ISOs can only be granted to employee

- For ISOs, the benefit flows to the employee — the employee need not pay income taxes on ISOs; instead, assuming the employee holds the options and the stock for the requisite minimum period and meets other conditions,

- The employee is only taxed on the difference between the exercise price and the fair market value at the time of exercise at the long-term capital gains rate (which is lower than the income tax rate).

Non-qualified stock options (NQOs):

- Independent contractors must receive non-qualified stock options (NQOs).

- The holders of NQOs must include the value in their income (and must also pay the capital gains tax upon exercise); however, the issuer (employer) may deduct from its own taxes the amount that the option holder must declare in his or her income.

--ISOs and NQOs are IRS classifications, each of which has tax benefits flowing to a different party. |

|